- Label : Investment Articles

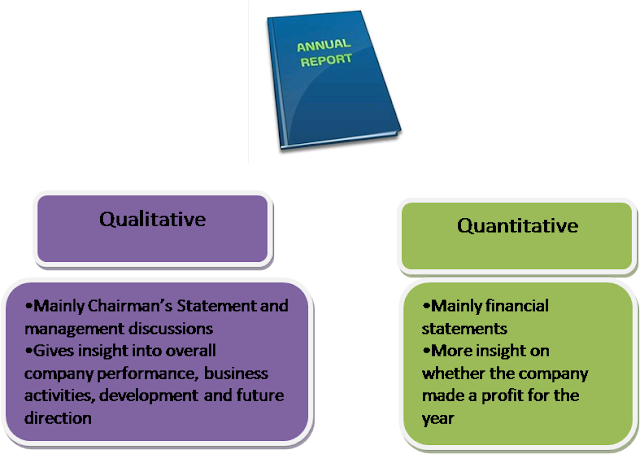

The annual report is a key information source for shareholders of a company to find out its performance in the previous financial year. Its content can be divided into two main categories: quantitative and qualitative. The sections under the quantitative category are basically the financial statements of the company.

We always talk about scrutinising the financial statements in the report to understand whether the company made any profit for the year. However, the qualitative category, which consists mainly of the Chairman’s Statement and management discussion, is getting more attention as investors realise that by going through these contents they can gain insight into the overall company performance, business activities, development and future directions – the qualitative part of business – to help them make buying or selling decisions.

Chairman’s Statement

In an annual report, the Chairman’s Statement is always located at the start of the report. Since it is a voluntary disclosure – meaning there is no regulatory requirement or accounting guideline that applies to it – the statement usually comprises what the senior management of the company wants to disclose to the public. Often, the statement will try to exaggerate positive news during the good years and place less focus on bad news in lacklustre years. Therefore, unsophisticated investors may be misled by the optimistic message presented by the Chairman.

While we can use quantitative methods such as ratio analysis to interpret financial statements, recent studies on narrative accounting have focused on scrutinising the content of the statement to detect whether there is any difference between companies reporting good results versus those with bad results. This technique is called content analysis.

What is content analysis?

Content analysis is a technique that systematically categorizes words into various content categories using certain rules. It is a qualitative method of determining and classifying characteristics of interest based on sentence structure, types of words used, and other fundamental characteristics of communication. Narrative accounting uses this method to examine the content of companies’ narrative disclosures to predict company performance, bankruptcy and even detect potential fraud.

For example, research has found that when a company reports good performance and prospects, the words used tend to be more optimistic and compelling. The discussion of its performance is more elaborate, most of the time with references and supporting financial materials. Success will also be attributed to the company’s management.

On the other hand, if the company is reporting poor performance, lengthy explanations about business activities or financial performance are withheld, especially for those involving issues. Even when negative issues are brought up, the explanation given tends to be ambiguous and will most likely focus on external factors beyond the management’s control. In some cases, when the company is trying to hide bad news from the public or is facing a crisis that has not yet been made known to the public, more often than not the statement will avoid words that indicate certainty or commit the company to a particular position.

To manage public perception, graphic presentations and attractive photographs are also added to the statement. However, at times, these serve as nothing more than additional distractions to steer investors’ attention away from hidden issues. Graphs containing financial information or trend charts are also sometimes made to exaggerate, maximising the effect of good performance while minimising the impact of the bad.

Conclusion

Most of the time, the Chairman’s Statement is presented in a very impressive manner. However, investors should not rely on first impressions when reading the statement. While it can be a useful guide to the company’s performance and future prospects, investors should also read between the lines and study it carefully. From the statement, we can determine the truthfulness of the management of a company. If the statement is written in a doubtful and ambiguous way, investors should be more cautious in evaluating the company. Remember, a company’s good performance is usually always the result of a senior management team with strong emphasis on integrity and credibility.

© Securities Industry Development Corporation 2010. For more information on wise investing, log on to Malaysian Investor (www.min.com.my)